“Should I use RON 95 or go for the more expensive RON 97 fuel?” That’s a very common question among our readers and general Malaysian motorists alike. More recently – with fuel prices coming down and the difference between the two less significant than before – the issue has become more pertinent then ever.

Needless to say, there are countless theories on this matter scattered across the Internet: some for, and others against the use of higher-RON petrol fuels.

We at paultan.org thought it would be much simpler – not to mention conclusive – to just compare the two fuel grades directly, head-to-head against each other.

So RON 95 vs RON 97 – which one’s better, or rather, which one should you use? We gathered two units of the Volkswagen Polo Sedan and two Jetta TSIs to find out.

Why two pairs of vehicles, we hear you ask? Well, you’ve heard it all before: modern, more technologically advanced engines respond more to higher-grade fuels, you get bigger gains with a turbocharged engine compared to a naturally-aspirated one, so on and so forth. So, we though we’d cover both bases at once.

The Polo Sedan with its naturally-aspirated 1.6 litre MPI (multi-port injection) engine represents traditional, old-school vehicles, while the 1.4 litre twin-charged (turbocharged and supercharged), direct-injection TSI motor in the Jetta plays for the other team here.

First up, the test itself. We arranged a lengthy 230 km-odd route, including heading into the Kuala Lumpur city centre on a regular working week day (during rush hour, no less), then on to equal shares of both highways and twisty backroads to Tanjung Malim and back.

Heavy stop-wait-and-go traffic, clear and busy highways, tight B-road stretches – we

covered them all, and then some. It’s as real-world as it gets, we think, as far as single-day fuel tests go, encompassing all variations of driving conditions in Malaysia.

Before we started, we had emptied all the cars’ fuel tanks as much as we dared to, and filled them up with their respective fuels the day before the test. The cars were then driven around for a bit to get the engines accustomed to each fuel type. To maintain absolute parity between the vehicles, each car’s tyres were also pumped up to the recommended pressures.

On to the actual fuel test. For consistency’s sake, each car was filled up to the brim using the three-click method (wait for the fuel nozzle to automatically stop, repeat three times after 10 second intervals) with the same re-fuelling kiosk.

So we now had one Polo Sedan running on RON 95 fuel, with the other on RON 97. Ditto with the pair of Jettas. Off we went, then.

The four vehicles travelled in a loose convoy throughout the entire journey, each taking turns to lead. We changed drivers at the halfway point (between each pairs) to eliminate the effects of different driving styles (and the drivers’ weights too, of course). The air-con settings were kept identical between the two pairs too.

To keep the test as “real-world” as possible, the drivers followed the natural flow and speed of other road users, which meant that we kept a minimal distance to the car in front during traffic jams, and cruised between 100 to 130 km/h on the fast lane through clear highways. It wouldn’t have been realistic any other way, right?

At the end of the route, the convoy covered exactly 236.7 km of mixed driving conditions. Each car was then re-fuelled to the brim again with the same process described above (identical three-click method, using the same petrol kiosk) to see the exact amount of fuel used.

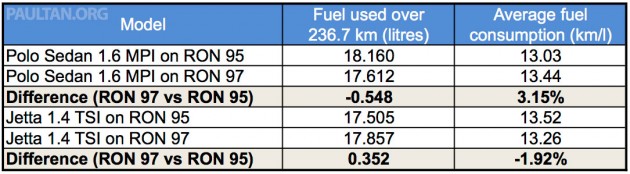

The results are as such: the Polo Sedan on RON 95 used precisely 18.160 litres of fuel, while the one on RON 97 used 17.612 litres. Those figures correspond to 13.03 km per litre (7.67 l/100 km) for the car on RON 95, and 13.44 km per litre (7.44 l/100 km) for the RON 97 test car. That’s a difference of 3.15% in favour of RON 97 (using RON 95’s number as the baseline).

As for the Jettas, the RON 95 car used 17.505 litres (averaging 13.52 km per litre or 7.40 l/100 km), compared to the RON 97 test car’s 17.857 litres (13.26 km per litre or 7.54 l/100 km). The difference stands at -1.92%, in favour of RON 95. And yes, this surprised us too.

Refer to the table above for the full results. In short, with the Volkswagen Polo Sedan 1.6 MPI, using RON 97 fuel brings a fuel economy gain of 3.15%. The Jetta 1.4 TSI, on the other hand, suffered a small deficit of 1.92% with the higher-grade fuel.

Now, the cost factor comes in. As things stand right now, RON 97 fuel (RM2.00 per litre) carries a 17.65% premium over regular RON 95 (RM1.70 per litre). Even allowing for a 5% margin of error either way, this test suggests that the cheaper fuel is still the way to go from a financial point of view.

As for claims that higher RON fuel offers better engine performance, it has to be said that none of the four drivers felt any discernible difference between the two fuels. Read into this what you will, of course, but based on our results, it looks like the paultan.org crew will continue to feed our personal cars with RON 95 fuel. Over to you: do you use RON 95 or RON 97, and why?

Read more: http://paultan.org/